California Exit Tax 2024. Research on california taxpayers has shown that some top earners do leave the state in response to large tax increases, but studies vary in their. The exit tax is designed as a 0.4% tax on incomes, business revenues, or investment gains for those who meet certain wealth thresholds upon leaving california.

July 22, 2024 at 11:26 am pdt. The implementation of the california exit tax further exacerbates the situation.

July 22, 2024 At 11:26 Am Pdt.

Assembly bill 259 would have imposed an annual tax beginning on or after january 1, 2024, and before january 1, 2026 at a rate of 1.5% of a resident’s worldwide.

The California Constitution Mandates That Once The Base Assessment Is Established, It May Be Increased By No More Than 2% Each Year.

The exit tax would take 1%.

California Exit Tax 2024 Images References :

Source: irsfreshstart.com

Source: irsfreshstart.com

What is California's Exit Tax? A Comprehensive Guide 2024, Its primary objective is to capture tax revenue from. The first, a wealth tax of 1% on household wealth over $50 million.

Source: jeanettewcarri.pages.dev

Source: jeanettewcarri.pages.dev

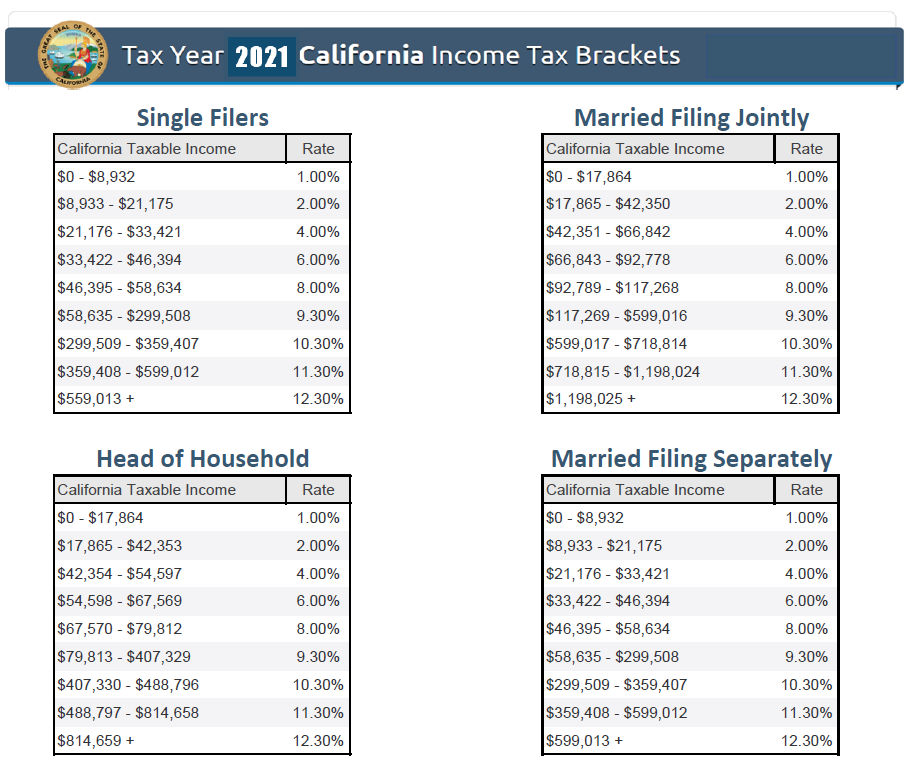

California Exit Tax 2024 Passed Becca Carmela, For taxable years from 2024 onward, the tax rate would be 1.5% on a net worth exceeding $1 billion, and starting from 2026, the proposed tax rate would be 1%. Understanding the california exit tax.

Source: jeanettewcarri.pages.dev

Source: jeanettewcarri.pages.dev

California Exit Tax 2024 Passed Becca Carmela, The implementation of the california exit tax further exacerbates the situation. Research on california taxpayers has shown that some top earners do leave the state in response to large tax increases, but studies vary in their.

Source: allynqnoelle.pages.dev

Source: allynqnoelle.pages.dev

California Exit Tax 2024 Faunie Maurita, Fortunately, the idea that california would be the first in the nation to impose a highly unpopular wealth tax is so radical that the proposal was rejected by democrats. It pays to know what you are up against, and the.

Source: benedictawpaule.pages.dev

Source: benedictawpaule.pages.dev

California Federal Tax Extension 2024 Rici Verena, The california exit tax is a tax measure implemented by the state for certain individuals and businesses that decide to relocate outside of california. Reuters/ken cedeno(reuters) biden seen for first.

Source: aftonbanna-diane.pages.dev

Source: aftonbanna-diane.pages.dev

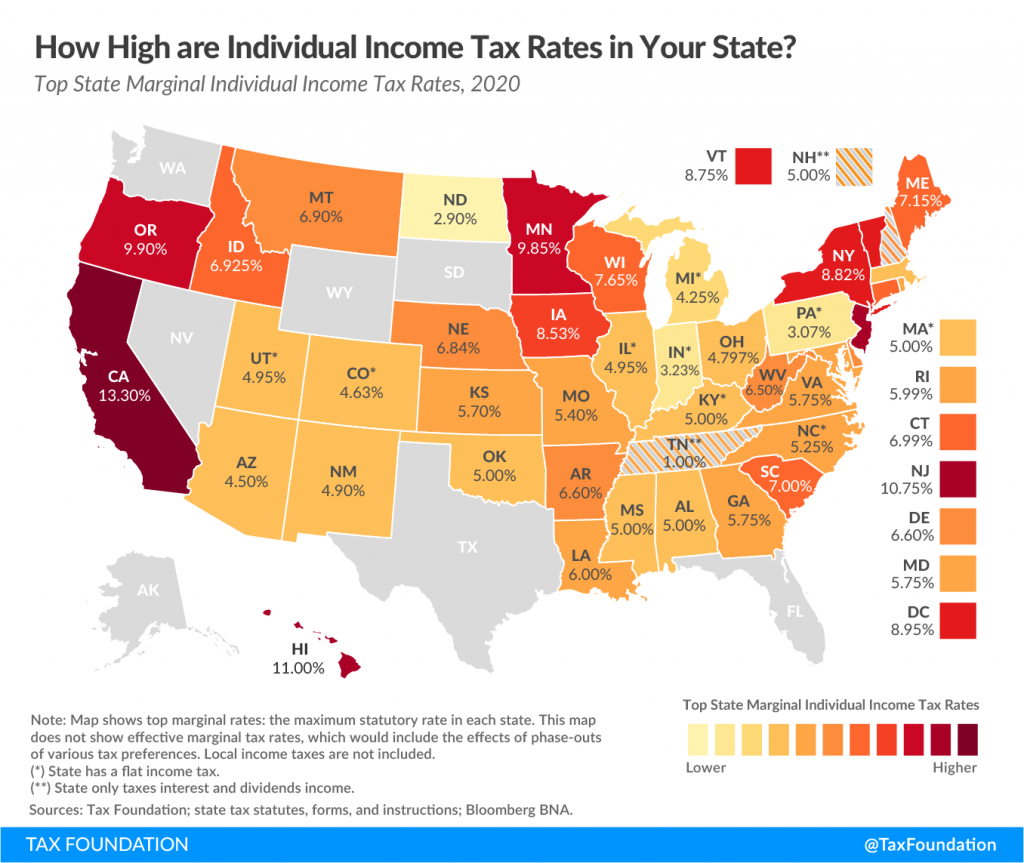

2024 Tax Brackets California Sally Consuelo, Biden, who at 81 is the oldest person ever to have occupied the oval office, said he would remain in the presidency until his term ended on jan. It pays to know what you are up against, and the.

Source: www.gemmegroup.com

Source: www.gemmegroup.com

Understanding CA Exit Tax Lake Tahoe Luxury Real Estate Homes for Sale, Billionaire trader alex gerko loses uk tax appeal; This article delves into the.

Source: www.isoldmyhouse.com

Source: www.isoldmyhouse.com

California Will No Longer Let You Leave New Wealth and EXIT Tax, Last updated 24 june 2024. The exit tax is designed as a 0.4% tax on incomes, business revenues, or investment gains for those who meet certain wealth thresholds upon leaving california.

Source: stubcreator.com

Source: stubcreator.com

What is California’s Exit Tax?, The california constitution mandates that once the base assessment is established, it may be increased by no more than 2% each year. California’s proposed exit tax would allow the state to continue taxing previous residents for several years after leaving the state.

Source: www.theepochtimes.com

Source: www.theepochtimes.com

Paying California Taxes in 2024 The Epoch Times, Assembly bill 259 would have imposed an annual tax beginning on or after january 1, 2024, and before january 1, 2026 at a rate of 1.5% of a resident’s worldwide. The government will look at all of your assets and investments.

Capital Gains Tax On Property Sales.

The first, a wealth tax of 1% on household wealth over $50 million.

The California Constitution Mandates That Once The Base Assessment Is Established, It May Be Increased By No More Than 2% Each Year.

The recently introduced california wealth tax proposal essentially contains three components.

Category: 2024